Budgeting and Monitoring

Budgeting and tracking my cash flow is my happy place. It’d be a happier place if I had more of the latter, but I don’t, so the former becomes vital. Luckily, I like to organize stuff, and what is money but stuff you trade for other stuff?

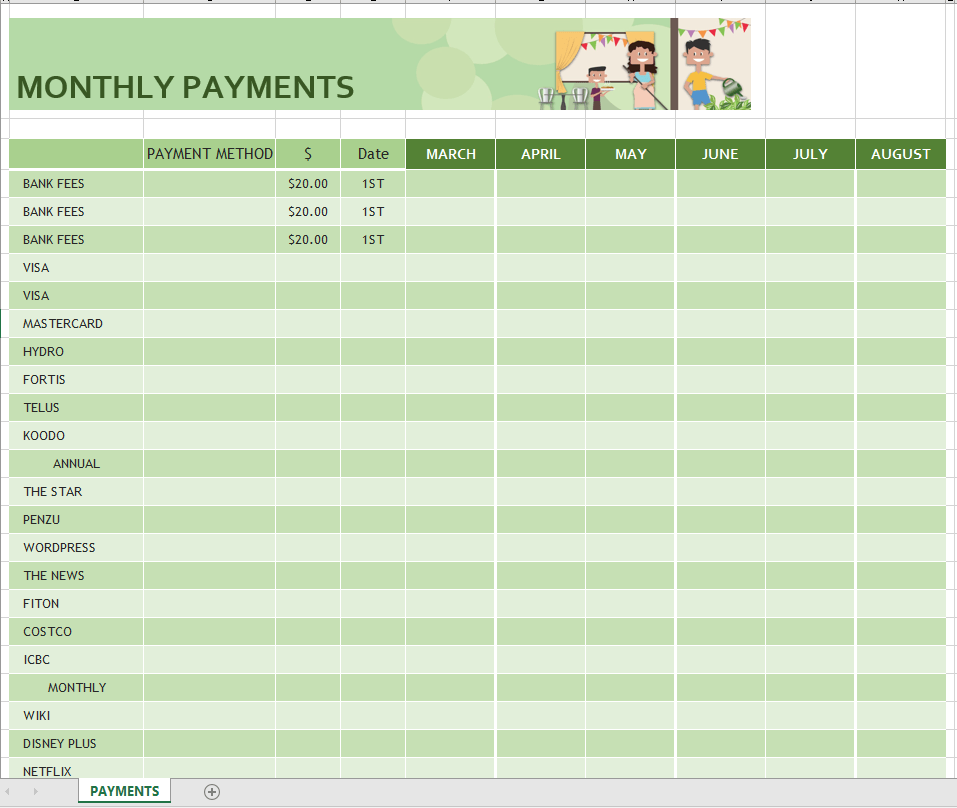

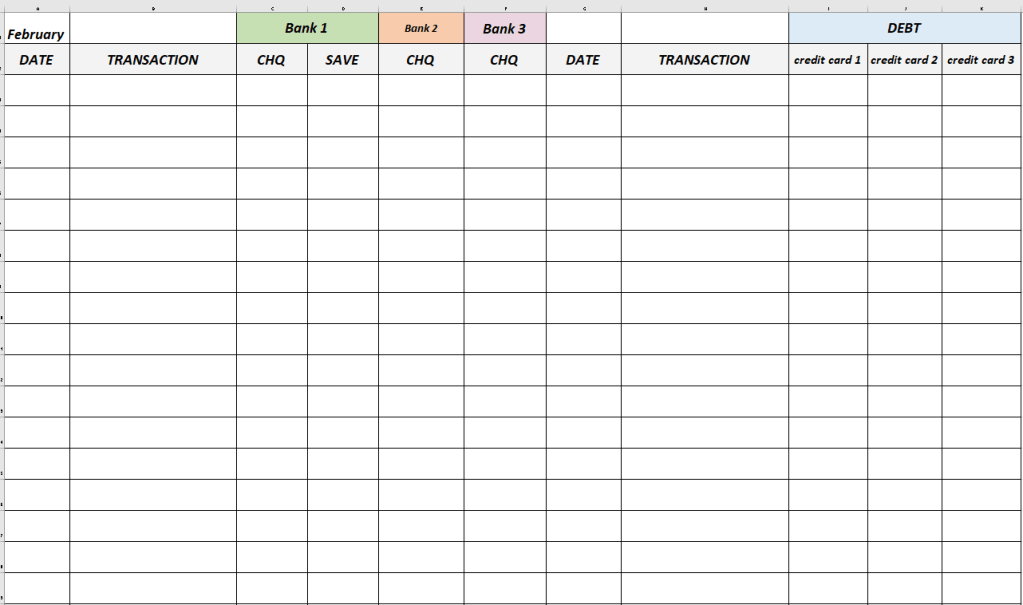

I have a binder in my office that I use to track the money as it comes in and goes out. I set it up myself as I couldn’t find a pre-produced one that worked. It includes a spreadsheet that lists all my fixed expenses, the dates they’re due, whether they’re pre-authorized, where the money is coming from, and daily record-keeping pages. I also have sections for paperwork I need to keep, such as tax records and paperwork relating to my home.

Banking

I have three banks I do business at. I keep my chequing and savings accounts at Bank 1, and I keep my debt – and a small balance in the requisite chequing account – at Bank 2. If you run into financial difficulties and can’t pay the money due the credit company on a given month for some reason, they will hit up your other accounts for the cash. They’re not nice about it, either: they’ll take it all if that’s what’s owing.

They can’t take what isn’t there, however, and they can’t scoop from a different financial entity.

I inherited the third account when my mother died. She added me to her accounts so that when she passed, the monies didn’t go into her estate, but rather passed to me as the other account holder. There’s less paperwork when things are owned in common with someone else and a death occurs.

We did the same with her car, and with my father’s as well. It’s helpful. The only caveat I would put into place is that one must be sure one is sharing “ownership” of assets with someone trustworthy. I signed the paperwork and then put the co-ownership out of my mind. It wasn’t designed for the present, after all.

Making Payments

I pay most of my bills on the same day, so the date on the invoice is irrelevant to me. I paid several in advance years ago to be able to line things up this way. It made for a couple of tight months, but I like the ease of a system that sees most of the money leaving on or near the same date. That way, I have an accurate perception of the balance I have available until the next tranche of money arrives.

The date I went with is the twentieth: that’s when my disability cheque comes in. It’s nice being mostly done with financial obligations in one blow.

I’m careful and focused with my money for two reasons: one, I don’t have a large income, especially now that I’m on disability. I have to be vigilant with where the money goes. Debt is easy to acquire and hard to shake off. Two, by my mid-thirties, I’d acquired a rather enormous debt load, well over thirty thousand dollars, and only about eight thousand was due to student loans.

Bulimia is a very expensive habit. That’s a truth even counsellors didn’t seem to think about, at least until I pointed it out.

I tried hard to negotiate a consumer settlement, but the credit card companies were uninterested, so I was left with the option of bankruptcy. That was a hard and humiliating year. I felt like a failure, for all that corporations declare it on the daily. But I learned well the lesson that debt is a hard beast to shake. It’s best to keep the amount you owe low.

It’s not in our best interest to make banks and credit card companies rich.

The Daily Spend

I also track my daily spending. I’m that annoying person who asks for the receipts. Paying with your phone also creates a nice summary record. I enter every purchase I make the day I make it, so I always know, pretty much to the penny, how much cash I’m holding at any given time.

I’d probably enjoy the process more if my savings and carry-over balances were more robust (or existent), but organizing soothes me, even when it’s moving electronic cash.

Ledgers are basically closet organizers for coins, and I do love a well-turned-out wardrobe.

I took an accounting course in high school. It seemed like a reasonably elective with less homework than some others. It has proven to be invaluable over the years. I think money management and the basics of record-keeping should be taught to everyone before they leave high school. Practical knowledge of any type is good to have.

What I learned in the course also helped me design the daily ledger pages I use. I find these kinds of things work best if they’re personally tweaked, though preproduced and templates one can alter abound.

My friends mostly don’t keep track of their money this obsessively. It’s probably why they have more service-shut-off stories than I do.

The Templates

Further Reading

The Difference Between Budget and Budgeting

How To Budget in Seven Simple Steps